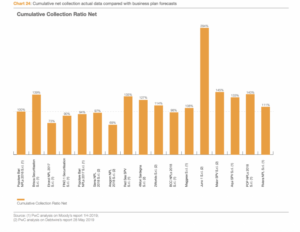

Even though the Gacs warranty of the Italian Government allowed to reduce the amount of Npls for the Italian banks, the credit recovery stage is not as successful (see here a previous post by BeBeez). This has an impact on the secondary market sales of shares that Gacs-backed spvs issue. Between 2015 and 2019 Italian banks sold more than 200 billion of distressed credits, 69 billion of them through Gacs-backed securitizations that issued asset backed securities amounting to 16 billion, for a median price of 23-24% of the face value. A report that PWC issued in December 2019 outlined that senior notes are worth 19% of the face value, abs mezzanine 3%, and junior notes 2%. Banca Ifis report Market Watch provided similar results. Norman Pepe, a partner of law firm Italian Legal Services (ILS), said to BeBeez such a situation suggests to no longer consider the Gacs operations as a terminal phase of the process of management and recovery of non-performing loans, but as an intermediate stage through which to pour these masses of NPL in smaller tranches in an organized, efficient and transparent way.

Even though the Gacs warranty of the Italian Government allowed to reduce the amount of Npls for the Italian banks, the credit recovery stage is not as successful (see here a previous post by BeBeez). This has an impact on the secondary market sales of shares that Gacs-backed spvs issue. Between 2015 and 2019 Italian banks sold more than 200 billion of distressed credits, 69 billion of them through Gacs-backed securitizations that issued asset backed securities amounting to 16 billion, for a median price of 23-24% of the face value. A report that PWC issued in December 2019 outlined that senior notes are worth 19% of the face value, abs mezzanine 3%, and junior notes 2%. Banca Ifis report Market Watch provided similar results. Norman Pepe, a partner of law firm Italian Legal Services (ILS), said to BeBeez such a situation suggests to no longer consider the Gacs operations as a terminal phase of the process of management and recovery of non-performing loans, but as an intermediate stage through which to pour these masses of NPL in smaller tranches in an organized, efficient and transparent way.

BeBeez is again the media partner for the NPL Europe 2020 Summit of Smith Novak that will take place on 5 and 6 March at the Hilton Tower Bridge Hotel in London (see here a previous post by BeBeez). More than 350 delegates from above 30 countries will discuss with 100+ speakers about Npls, Utp, corporate credits, shipping, and real estate. Further information available here

Credito Valtellinese (CreVal) sold to Hoist Finance an amount of unsecured Npls worth 357 million euros (see here a previous post by BeBeez). Such a sale hasn’t any impact on CreVal’s profit and loss and is part of the bank0s plan for selling 800 million grossly worth distressed credits by 2020 and lowering the Npe to 9.4% from 11,3% recorded at the end of 3Q19, as ceo Luigi Lovaglio reportedly said. In 2021, the bank aims to reduce the ratio to below 7%. At the end of 4Q19, CreVal distressed credits amounted to 1.535 billion (1.91 billion in 3Q19).

Illimity acquired secured corporate Npls amounting to 285 million euros and sold retail Npls worth 182 million (see here a previous post by BeBeez). Illimity purchased 115 million of Npls from Unicredit and 170 million from an undisclosed investor in distressed credits. Illimity sold a portafolio of unsecured retail Npls worth 182 million to Sorec, Phinance Partners, and CGM Italia.

Bcc Credito Padano (part of Iccrea) sold 12.8 million euros of Npls to Balbec Capital which carried on the acquisition through a securitization spv (see here a previous post by BeBeez). Balbec Capital is an investor in distressed credits that since 2011 acquired assets for 5 billion US Dollars in 19 countries. In January 2020, Balbec Capital acquired from Banca Valsabbina a 19.6 million euros portfolio of secured distressed credits, while in November 2019 it acquired together with APS Holding a portfolio of NPLs worth 50 million from Unicredit Bulgaria. Paolo Innocenti heads Bcc Credito Padano that was born in 2016 after an integration with Banca Cremonese, parto of Bcc di Castel Goffredo. Credito Padano is one of the banks that swapped UTPs for equity of Clessidra Restructuring Fund.

Unicredit’s non-core distressed credits for 2019 amount to 8.6 billion euros, below the 19.2 billion target (see here a previous post by BeBeez). In December 2019, Unicredit’s ceo Jean Paul Mustier said that the bank’s non-core distressed credits will be below 5 billion at the end of 2020 in view of a total run down scheduled for 2021. The bank has a 5% gross Npe with a 1.8% ratio of net distressed credits over the total credits.

Banca Sella and B2 Kapital, the Italian subsidiary of Norway-listed NPL investor B2Holding, signed a partnership for the acquisition of secured and unsecured third-parties banking and financial NPLs (see here a previous post by BeBeez). Massimo De Donno is the head of Banca Sella credit department. After such a partnership, B2 Kapital will no longer act as exclusive platform for B2 Holding and will be a servicer for further investors. Francesco Fedele is the Italian country manager of B2Holding and a managing director of B2 Kapital. In April 2019, B2 Kapital acquired a 46 million euros worth portfolio of NPLs from CentroMarca Banca di Credito Cooperativo di Treviso e Venezia, while in July 2019, it acquired a 24.5 million portfolio of secured and unsecured credits from Bosnia’s UniCredit a.d. Banja Luka and UniCredit Bank d.d. Mostar.

Mps achieved two years in advance the target of distressed credits reduction (see here a previous post by BeBeez). At the end of 2019 the bank’s amount of distressed credits is of 12 billion euros (16.8 billion at the end of 2018), down by 2.6 billion since the end of September. At the end of December 2019, Mps sold a portfolio of NPLs worth 1.6 billion to Illimity for a total amount of sold distressed credits worth 3.8 billion, for a pro-forma Npl ratio of 12.5%, reaching 2 years ahead the 12.9% target set for 2021. See here the latest BeBeez Report find out here how to subscribe to BeBeez News Premium for just 20 euros per month and read the BeBeez Reports and Insight Views. MPS received two binding offers from Blackstone and Ardian for its real estate assets.

Banca Popolare di Sondrio is about to close the sale of a one billion euros worth portfolio of Npls through a Gacs-backed securitization (see here a previous post by BeBeez). After such a sale, the bank will keep implementing its derisking strategy with the sale of a further 500 million portfolio and through the strengthening of the debt recovery department. In 2019, Popolare di Sondrio reduced by 11.4% the amount of its distressed credits that now amounts to 3.7 billion for a 12.5% NPE ratio (14.8% yoy). The bank’s Npe coverage ratio is of 58.39% (55.64%), while the Npl coverage ratio is of 71.02% (69.36%).

Ubi Banca said it aims to sell a portfolio of corporate Npls with a face value of 800 million euros by the end of 2020 (see here a previous post by BeBeez). Once closed such a sale, UBI’s NPLs will be 6.9% of the gross credits (currently 7.8% from 15.5% in 3Q15). Ubi Banca also said that the total amount of distressed credits stands at 6.838,5 million (-1.474,3 million or -17.7% from 8.312,8 million in September 2019 and -2.878,3 million or -29.6% from 9.716,8 million in December 2018). Find out here how to subscribe to BeBeez News Premium for just 20 euros per month and read the BeBeez Reports and Insight Views about Gacs and NPLs deals.

Italian instant buyer of real estate assets Casavo issued a bond that Amundi Progetto Italia subscribed (see here a previous post by BeBeez). Giuseppe Caputo, the company’s cfo, said that the company will invest the undisclosed proceeds of such issuance in its organic growth. In June 2019, Casavo raised a direct lending round of 25 million euros from un unnamed lender. Greenoaks Capital lead the pool of investors that in October 2019 poured 30 million of venture debt in Casavo. Find out here how to subscribe to BeBeez News Premium for just 20 euros per month and read the BeBeez Reports and Insight Views that include the Report Venture 2019. Giorgio Tinacci and Simon Specka founded Casavo in 2017. However, Specka sold his stake in early 2019.

Antonio Carraro, an Italian producer of tractors for vineyards and orchards, issued a 12 million euros minibond due to mature in 2024 and paying a 3.5% coupon (See here a previous post by BeBeez). Fondo Veneto Minibond and other 10 investors subscribed the bond. Antonio Carraro is the chairman of the company that has sales of 103 million with an ebitda of 8.72 million. In December 2019, Fondo Veneto Minibond, Iccrea BancaImpresa, and Banco Tre Venezie subscribed a 3 million minibond that Italian urban furniture company Metalco issued. Veneto Sviluppo is one of the investors that BeBeez Private Data monitors. Find out here how to subscribe to the Combo Version that includes the reports and the insight views of BeBeez News Premium 12 months for 110 euros per month.

Italian paper producer Burgo Group received the certifications Prassi UNI 44:2018 (Prassi) and TÜV Rheinland CMC:2012 (CMC) for its system for credits management (see here a previous post by BeBeez). UNI (Ente Italiano di Normazione) and ACMI (Associazione Credit Manager Italia) created the Prassi procedure in October 2018, while TÜV Rheinland created the CMC standards on the grounds of the guidelines of Bundesverband Credit Management e.V. (BvCM). Both the protocols set a standard for the credit management system. Andrea Porelli is the head of Burgo’s credit management department. The company belongs to Holding Gruppo Marchi (50.59%), Mediobanca (22.12%), Unicredit (3.83%), Generali Financial Holding, and Italmobiliare (11.68% each). At the end of 2015, Pillarstone Italy acquired the convertible credits that Unicredit and Intesa Sanpaolo had toward Burgo, which reportedly attracted the interest of QuattroR, a turnaround investor that may subscribe a capital increase that the company may launch in the next months. Burgo has sales of 1.883 billion euros (2 billion yoy after the sale of Burgo Energia) with an ebitda of 137 million (+3.8% from 132 million) and a net financial debt of 487 million (535 million).